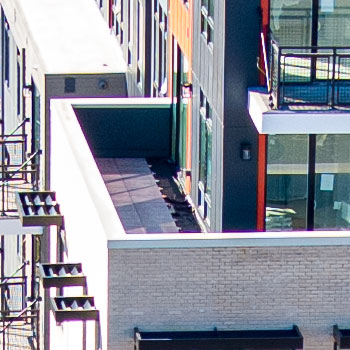

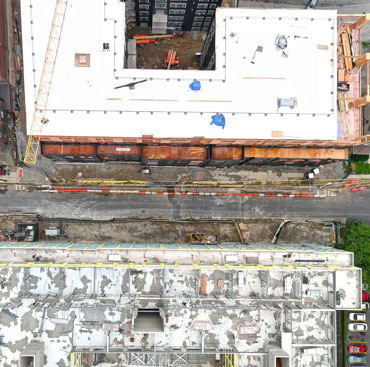

Eight story mixed-use project with 334 units - 8 studios, 201 one-bedroom and 125 two-bedroom. Project contains three courtyards, parish center and pedestrian walkway. Developer: Mill Creek Residential

- Mill Creek Announces Start of Preleasing at Modera New Rochelle (1/12/2022)

- Renderings Revealed For The Modera At 24 Maple Avenue In New Rochelle (7/15/2020)

- The Modera to feature upscale apartments in New Rochelle - by Matthew O'Shaughnessy (6/16/2020)

- Blessed Sacrament redevelopment in New Rochelle inches forward (2/10/2020)

- Blessed Sacrament site in New Rochelle is sold to make way for apartment project (2/10/2020)

- Mill Creek Residential looks to buy former New Rochelle school for 338-unit rental project (3/28/2019)

- New Rochelle: Defunct Blessed Sacrament school could be site of latest downtown development (3/26/2019)

Zone: D0-3

Project Videos HERE

News

Progress Gallery

Project Data*

Building

Studios: 8

1BR: 201

2BR: 125

3BR: 0

4BR: 0

Affordable: 34

Total: 334

Parking: 334

Stories: 8

Retail Space: 0 sqft

Occupancy

Students: 20

School: Trinity

Jobs

Permanent FT: 10

Permanent PT:

Dates

Planning Board Approval:

IDA Approval: 6/26/2019

Constr. Start: 12/1/2019

Length: 36

Completion: 11/30/2022

Tax Incentives

Full Property Tax: $31,773,281

PILOT: $19,166,536

Owner Savings: $12,606,745

PILOT (yrs): 20

Mortgage Tax Exemption: $843612

Fair Share Mitigation: $1,178,978

Data Last Updated: 7/3/2019

*Data listed here is subject to change. FOIL/FOIA requests are pending to obtain any missing data. Some of these numbers are estimated. Data comes from city documents.

** GLOSSARY TERMS: "As Is" taxes are the taxes of the property before development. Full Property Taxes are the taxes of the property after development. PILOT means Payment in Lieu of Taxes, which is less than full property taxes. Owner savings is the property tax abatement in dollars and as a percent of Full Property Taxes. PILOT length is the number of years that the PILOT is in effect. Fair Share Mitigation (FSM) fees are monies collected by the City from the developer to cover future infrastructure needs. The school system gets approximately 2/3 of the FSM fees.

*** Residents are calculated as follows: Studios = 1, 1BR = 1.5, 2BR = 3, 3BR = 4.5 (NDC formula) Students are calculated as follows: Studios (*0), 1BR (*0.014), 2BR (*0.141), 3BR (*0.213) (NDC formula)

*Data updating and collection is done by volunteers and may contain the occasional error or miscalculation.

** New Rochelle Parking Code including Minimum number of Spaces